oregon tax payment address

Oregon Tax Payment Voucher Mailing Address will sometimes glitch and take you a long time to try different solutions. And you are filing a Form.

How To Do Payroll In Oregon What Employers Need To Know

Your cancelled check is your receipt.

. Oregon Tax Accounting LLC has been serving the Oregon and surrounding area since 2009. If you live in. Please mail property tax payments to.

Cigarette tax stamp orders. Go to Oregon Tax Payment Address website using the links below Step 2. Payment is due at this final appointment with different optional.

Oregon Tax Accounting LLC has been serving the Oregon and surrounding area since 2009. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. Based On Circumstances You May Already Qualify For Tax Relief.

Copy of your Oregon tax return. Enter your Username and Password and click on Log In Step 3. LoginAsk is here to help you access Oregon Tax Payment Voucher.

Oregon Tax Payment System Oregon Department of Revenue. Welcome to the UI Tax Contact page. For the contact person.

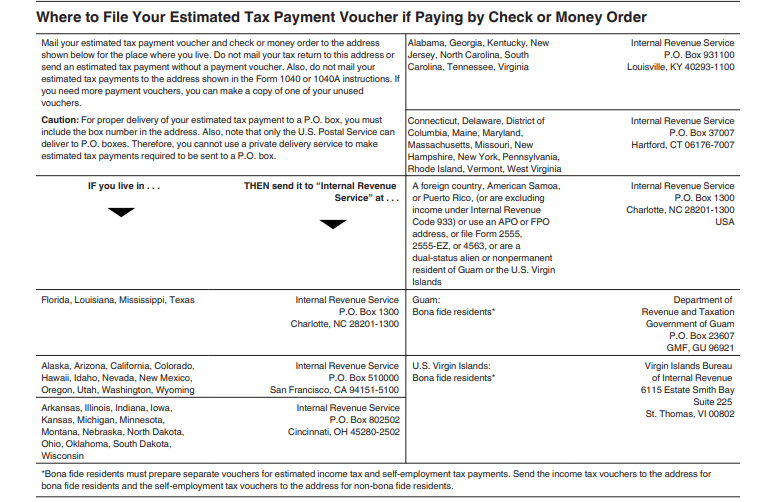

If there are any problems here are some. Benefits of registering on Revenue Online. Where to Send Balance Due Tax Account Payments.

Go to State Of Oregon Tax Payment Address website using the links below Step 2. Your browser appears to have cookies disabled. Estimated tax payments due june 15 2022.

Ad See If You Qualify For IRS Fresh Start Program. If there are any problems here are. Many companies will enter a generic tax dept email here.

Be advised that this payment application has been recently updated. Cookies are required to use this site. Your cancelled check is your receipt.

PO Box 3416 Portland OR 97208-3416. Please mail property tax payments to. Free Case Review Begin Online.

Ssn spouses first name initial. Marion County Tax Collection Dept. District of Columbia Idaho Kansas Maryland Montana Nebraska Nevada.

And you are not. Income Tax Returns No Payment Oregon Department of Revenue PO Box 14700 Salem OR. Amending to pay additional tax.

Oregon Department of Revenue - Mailing. However when we send our questions to generic emails our response rate is very low. Send your payments here.

Payments mailed to this address are. Details are available at oregon. Oregon Tax Payment System.

Enter your Username and Password and click on Log In Step 3. And you will sign your return. 7 rows If you live in Oregon.

2020 Tax Return Notices To Be Aware Of Go Green Tax

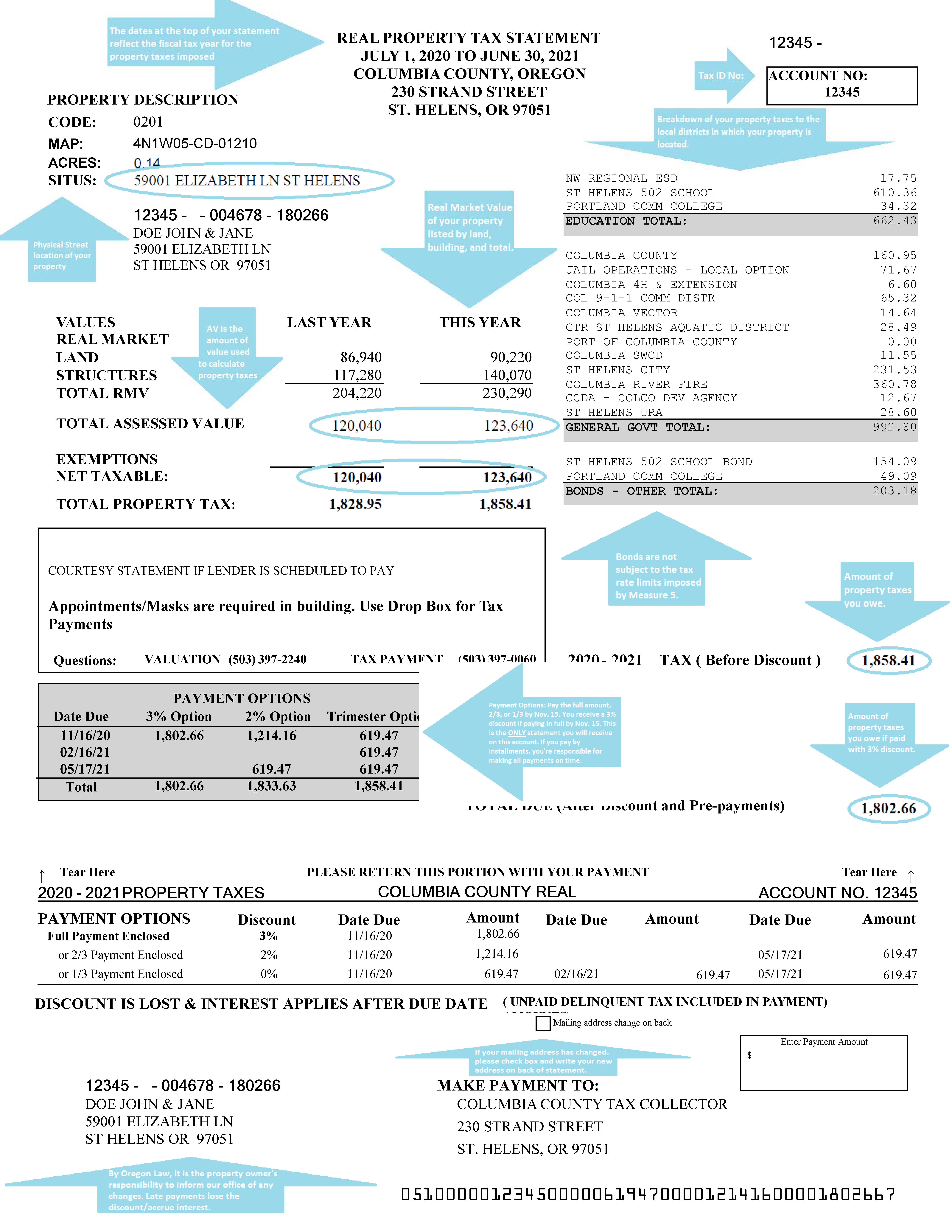

Columbia County Oregon Official Website Understanding Your Property Tax Statement

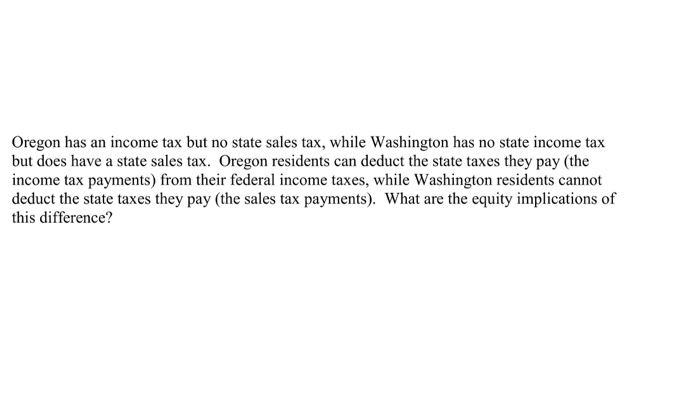

Solved Oregon Has An Income Tax But No State Sales Tax Chegg Com

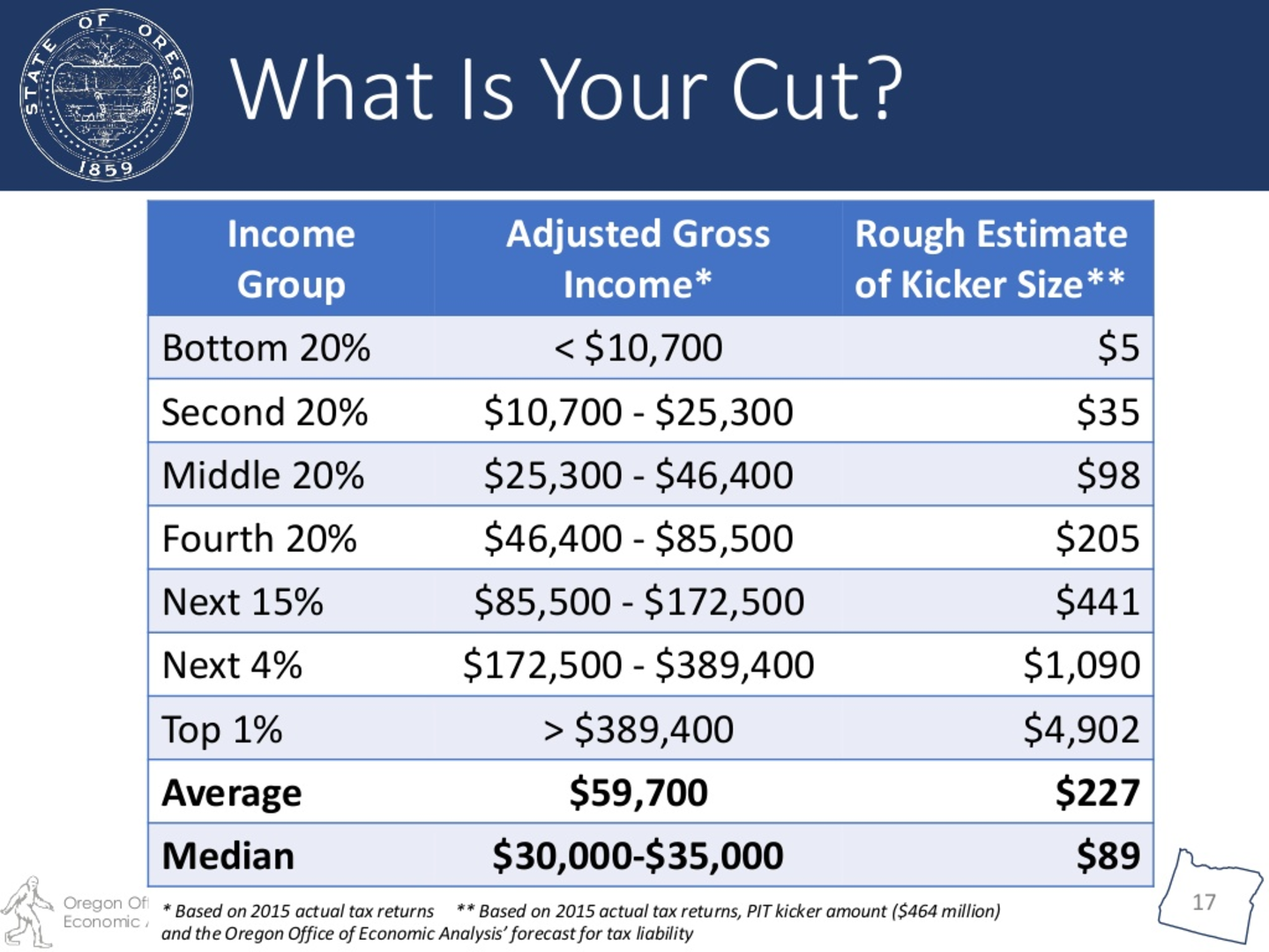

Here S The Kicker Oregonians To Receive A Tax Rebate In 2018 Opb

Where S My Refund Oregon H R Block

Want To Pay Lower Cell Phone Taxes Move To Oregon Geekwire

2021 Property Tax Statements Are Available Online Benton County Oregon

Oregon Revenue Dept Orrevenue Twitter

Federal Stimulus Could Mean Higher Oregon Tax Katu

Oregon Corporate Activity Tax First Payment Due April 30 Marcum Llp Accountants And Advisors

Estimated Tax Due Dates Do I Still Need To Pay

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

Oregon Estimated Income Fill Online Printable Fillable Blank Pdffiller

Tax Statement Explained Lincoln County Oregon

Look Up Your Property Tax Bill Multnomah County

Tax Payment Information Jefferson County Oregon

Oregon Insight How Families Spent Their First Child Tax Credit Payments Oregonlive Com